Being first may not always ensure success, but it can certainly provide an edge.

Consider the enduring rivalry between Coca-Cola and Pepsi. Both cola brands originated in the 19th century, yet Coca-Cola’s ability to capture market share with its nostalgic appeal can be partly credited to its earlier debut—preceding Pepsi by a notable seven years.

More importantly, this example highlights the concept of first-mover advantage. In the business world, this refers to the benefits—such as stronger brand recognition or increased sales—that a company gains by being the first to enter a market.

But what does being the first mean for property buyers in Singapore? Let’s delve into how the first-mover advantage applies to homebuyers and why it plays a crucial role in making informed property decisions.

So, should homebuyers pay attention to the first-mover advantage effect?

The concept of first-mover advantage applies to both business and real estate, with early participants typically reaping greater rewards than those who enter later.

That said, the application of this principle differs in real estate, where it’s often discussed in two distinct contexts.

The first scenario involves early buyers who act quickly during a property’s launch phase, securing their purchase at a more favorable price offered by developers.

The second—and more widely explored—scenario relates to buyers benefiting from capital appreciation by being among the first to invest in properties located in emerging, non-mature towns.

For the purpose of this discussion, we’ll focus on the latter, as it provides greater insight into how early investments in developing areas can translate into substantial capital gains over time.

So, should homebuyers pay attention to the first-mover advantage effect?

Singapore’s urban landscape has seen remarkable transformation over the decades, with once-quiet suburbs evolving into bustling town centers under the strategic guidance of the Urban Redevelopment Authority (URA).

Notable examples include Canberra, Tampines, and Punggol—areas that have flourished in recent years. Looking ahead, future hotspots like the Greater Southern Waterfront and the vicinity around Airport Road, where Paya Lebar Air Base will remain until the 2030s, are poised for similar growth. These are precisely the locations where the first-mover advantage becomes evident, offering early buyers opportunities to capitalize on the potential for value appreciation.

The development of 1 Canberra’s site from 2008 to 2021 (Source: Google Maps)

In 2019, Canberra welcomed the opening of its MRT station, enhancing connectivity for residents via the North-South Line. The following year, Canberra Plaza—a “New Generation Neighbourhood Centre”—was unveiled, offering a comprehensive mix of entertainment, retail, and dining options designed to cater to all ages.

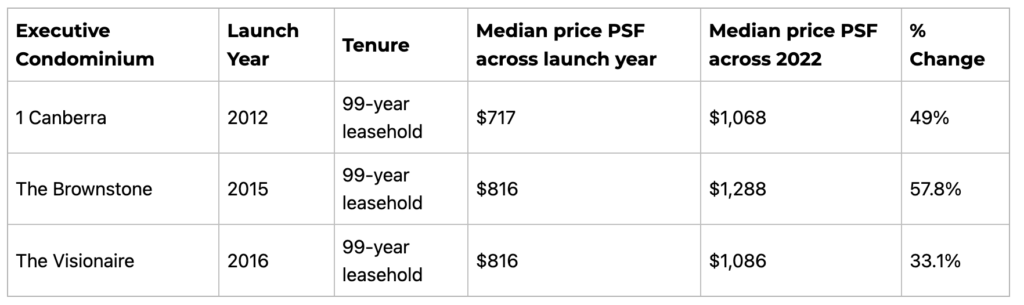

Years before these developments came to fruition, 1 Canberra, the town’s inaugural Executive Condominium (EC), was launched. Debuting with a median price of $717 per square foot (PSF), the property saw a remarkable 49% appreciation over the next decade, reaching $1,068 PSF—a testament to the first-mover advantage in action.

Source: URA Realis

Although not first-mover properties, both The Brownstone and The Visionaire—also Executive Condominiums (ECs)—were completed ahead of Canberra’s new amenities and have shown strong price growth. Launched in 2015 and 2016 with a median price of $816 PSF, The Brownstone saw a notable increase of 57.8%, reaching $1,288 PSF, while The Visionaire appreciated by 33.1%, rising to $1,086 PSF.

While 1 Canberra’s higher rate of appreciation compared to The Visionaire could suggest the influence of the first-mover advantage, The Brownstone’s outperformance highlights the potential impact of other contributing factors—an aspect we’ll delve into further.

Source: URA Realis

Looking at the median PSF price trends of Canberra’s 99-year leasehold condominiums, the case for the first-mover advantage becomes more compelling.

Yishun Emerald and Yishun Sapphire, both launched in 2000, can be considered Canberra’s first movers. Homes in these developments have outperformed their successors in terms of appreciation. Notably, Yishun Emerald’s median PSF price has climbed an impressive 84.7% since its launch, increasing from $469 to $867.

However, more recent developments—such as Eight Courtyards, Canberra Residences, and The Nautical—have not only narrowed the gap but, in some cases, surpassed the median PSF prices of these early entrants.

One potential factor behind this trend is lease decay. Given that Yishun Emerald and Yishun Sapphire were launched a decade earlier than their counterparts, their resale price growth may have slowed in absolute terms due to their shorter remaining lease periods.

Source: URA Realis

A comparable trend can be observed in Punggol, where the first-mover Prive has recorded substantial growth in its median PSF price, rising by an impressive 70.5% since its launch in 2011. However, in terms of absolute PSF prices, it now stands neck-and-neck with 99-year leasehold private condominiums introduced in subsequent years.

So, should homebuyers pay attention to the first-mover advantage effect?

From the examples above, it’s clear that the first-mover advantage can have a noticeable impact on a property’s performance. However, newer developments may close or even surpass the gap in PSF prices, influenced by various factors that affect appreciation rates.

These factors might include the overall housing supply in the area or proximity to emerging amenities like new MRT stations and shopping hubs.

In essence, being first can matter, but primarily in terms of relative percentage gains.

Disclaimer for Consumers

This information is shared in good faith and should not replace your responsibility to verify details with relevant sources or seek professional advice from valuers, financial advisers, bankers, or lawyers.