Since its inception in 1967, the Government Land Sales (GLS) programme has been a cornerstone of Singapore’s urban development, enabling the strategic release of state land to property developers and shaping the cityscape we see today.

But the importance of GLS launches goes beyond urban planning. These outcomes provide valuable insights into potential property price trends and the sentiment of developers in the market. This raises an important question: What can the latest GLS results reveal about the property market’s future direction?

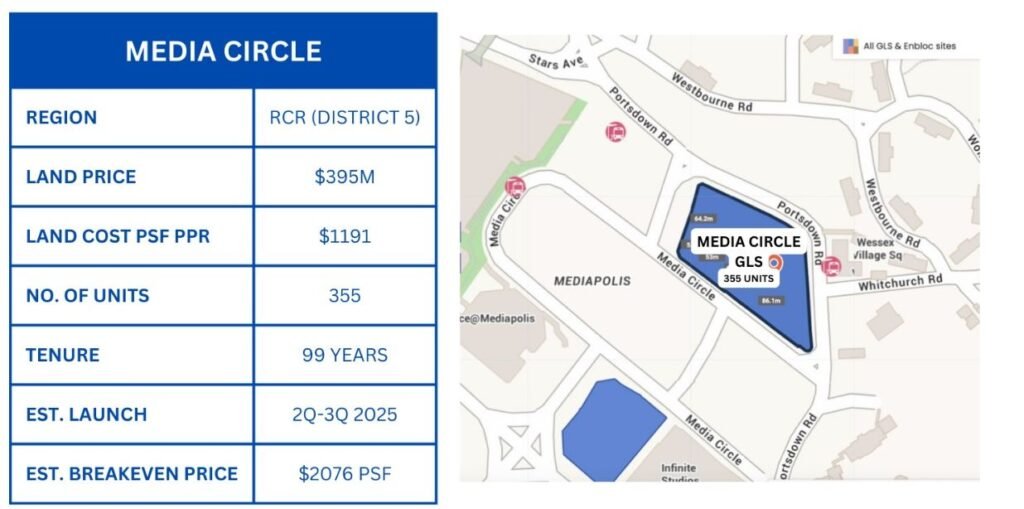

Take, for example, the recent GLS sites at Plantation Close and Media Circle. By analyzing these launches, we can glean insights into how developments at these locations might be valued in the coming years.

Plantation Close, designated for development as an Executive Condominium (EC), was successfully awarded to Hoi Hup Realty and Sunway Developments for a total bid of $423 million. This translates to a land cost of $701 per square foot per plot ratio (PSF PPR), providing a clear benchmark for the site’s future valuation.

The recent GLS launch at Media Circle saw Hoi Hup Realty secure the site with a winning bid of $395 million, translating to a land cost of approximately $1,191 per square foot per plot ratio (PSF PPR).

Given these land costs, the estimated future launch prices for homes at Plantation Close and Media Circle are projected to be around $1,550 PSF and $2,500 PSF, respectively. These projections align closely with the median prices of comparable developments in the surrounding areas.

Beyond providing insights into future launch prices, recent GLS sites and their outcomes can also help identify potential hidden gems in the surrounding areas.